10 Ways Businesses Can Adapt to the Current State of the U.S. Economy

A recession indicates a decline in the economic performance of a country. It’s usually reported by a decline in GDP for two consecutive quarters. Though unavoidable, the current state of the U.S. economy signals the coming of a recession that may have a greater impact than expected.

The current state of the U.S. economy is a worldwide matter that has investors, entrepreneurs, and industry experts on high alert. Entrepreneurs typically keep an eye out for economic forecasts as this affects their strategy in sustaining and growing their business.

Recessions typically involve businesses producing less revenue, workers losing jobs, and commodity prices rising, requiring people and businesses to make certain preparations when one is forecasted.

If your business has yet to be ready for an economic downturn, and the changes it brings, this article is for you.

Current State of the U.S. Economy

News recently broke out that the current state of the U.S. economy is indicative of an incoming recession, akin to that of The Great Recession in 2008.

This means that economic indicators are signaling an economic downturn that may be more devastating than what is typically expected.

Consumers and businesses alike can expect more expensive goods and services, higher interest rates, and a scarcity of some commodities.

While the economy typically cycles between ups and downs, institutions both private and government-funded continuously work to monitor indicators to anticipate and create policies that help regulate the economy’s well-being.

Where is the GDP at?

The alarming -3.5% reported growth in 2020 is currently being offset as 2021 closed at 5.7%, the fastest since 1984. Contributing to that were 2021 Q4 reports of 6.9% growth, affected by a growth in consumer spending, possibly influenced by the holiday season.

Discontinuing that trend, Q1 of 2022 shows a 1.4% growth, with a forecast of 1.1% for this next quarter. This slow growth is anticipated to pick up once pandemic measures affecting the global supply chain ease, reducing prices and increasing buyer confidence again.

Employment

The Great Resignation continues to evolve as 40% of workers left for remote or hybrid work, and 10% changed paths. The alarming 8.1% unemployment rate of 2020 has stooped down in 2021, but still remains elevated at 5.3%.

In spite of ongoing wage inflation, companies still continue to provide jobs, with attempts to remain competitive in employee compensation.

Unionizations in frontline work also continue to make it difficult for companies to continue as they did prior to the pandemic era. With organized workers demanding more from companies, employers are left looking for ways to fill in vacancies without breaking the bank.

Inflation

Healthy inflation rates are manageable and natural in the larger world economy. However, inflation has more than doubled recently, convincing economists that a recession may be incoming.

The inflation rate by 2021 was reported at 7.9%, beating a 40-year high. As of April 2022, the trend of seeing record inflation rates shows signs of persisting.

If high inflation and unemployment persist while production goes in the opposite direction, stagflation may be occurring, increasing the threat of an upcoming recession.

Industrial Production

The manufacturing sector continues on a growth trajectory, albeit at lower levels. This is due to a local labor shortage and the parts shortage in the global supply chain caused by recent lockdowns in China.

The global supply chain also continues to be affected by the war on Ukraine, with lower inventories hiking up prices and overall lowering demand among consumers.

Consumer Spending

Right now, consumer spending has grown to 1.1% in March, in spite of the 1.4% inflation that outpaces it.

Economists forecast that spending may slow down due to rising gas and commodity prices. Consumer savings have gone back to a pre-pandemic level of 6.2% from 6.8%.

When the savings rate continues to lower, consumer spending may continue and revenues of businesses might follow suit.

Fed Rates

The Federal Reserve Board decides the rates of interest between banks in America. Effects from their decision ripple throughout the economy.

The Fed announced its plans to continue raising interest rates (to 1.75%-2% by August) to cool down the demand for goods and services, combating rising price inflation. This is after already making the biggest rate hike in two decades.

Market Predictions in Fruition

In January 2022, the global economic outlook expected less growth and more inflation. This was due to the lingering effects of the covid-19 pandemic still affecting multiple facets of the economy.

April of this year, the World Economic Outlook released an update reporting worsening conditions for the future. The IMF contributes an update on the negative effects that the war on Ukraine has on local prices and supplies.

Global growth is now forecasted at 3.6%, lower than January’s 4.4%, and 2021’s 5.9%. Worker shortage continues and job openings in the US are already at an all-time high.

This excess demand for labor results in more spending as companies increase wages or move to areas where workers are in abundance.

Is a Recession Coming?

Fed rates continue to increase, possibly in hopes of helping banks recover from the pandemic.

Continued job vacancies affecting consumer and business spending, however, could contribute to losses that would lead to a recession.

GDP has already experienced -1.4% growth in the first quarter of 2022, alerting experts for what could possibly come after.

While the pandemic allowed more savings for a lot of Americans, continued spending may halt, even with the wage inflation, due to price inflation.

Consecutive contractions in the GDP typically signal a recession, but Wall Street firms have yet to agree on whether a recession is coming or not.

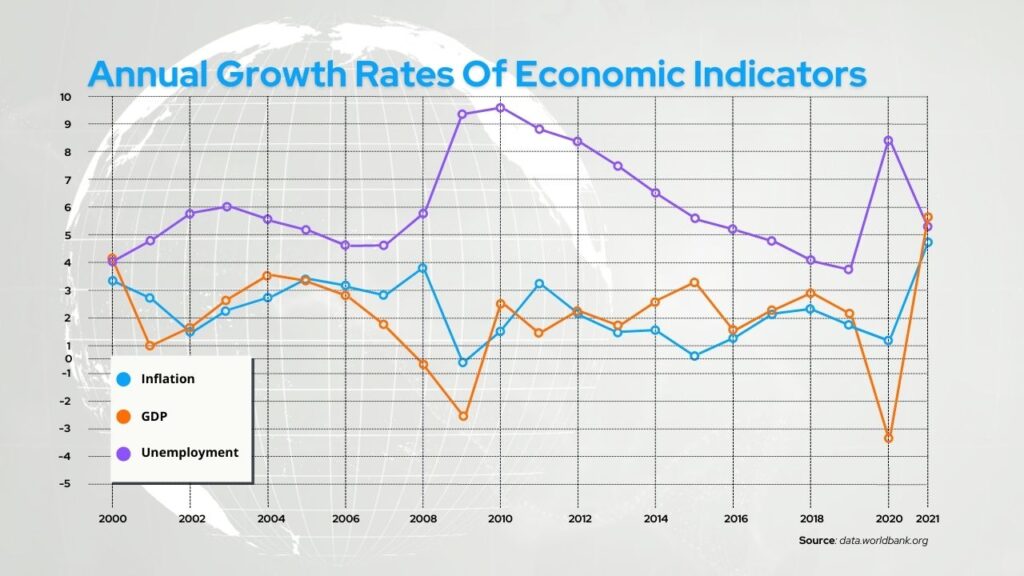

Here’s a graph showing the relationship between 3 economic growth indicators. Note how the pattern looks before The Great Recession between 2007 and 2009.

What You Can Do

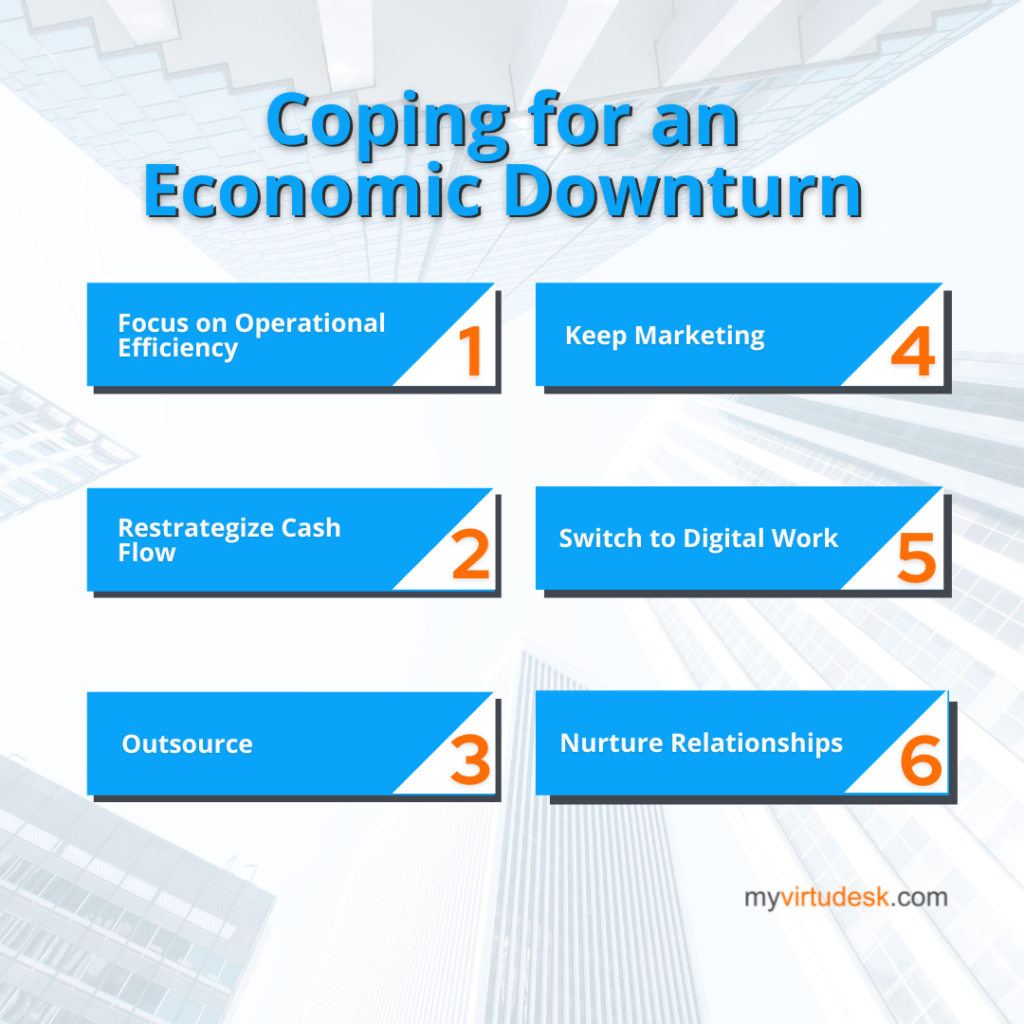

With the economy fluctuating as it did in the past three years, it’s wise to stay alert in case another bad recession comes along. The economy may suffer, but your business can have a higher chance of surviving when you follow these steps.

1. Restrategize Cash Flow

Beyond simply cutting down costs is also restrategizing your business’s finances. Recessions usually cause businesses to experience lower revenue, lowering budgets for all other activities.

Here’s where you need to realign your business’s goals as you wait for the economy to stabilize again. Perhaps production doesn’t need to be as robust given the lower expected sales.

Debt management is also a good strategy in this case. You can ask your suppliers to adjust interest rates or payment periods so you can better manage your finances. There are also loans and grants you can check out to help keep your business afloat.

The concept here is getting the most bang for your buck by securing options to sustain your company while sales are expected to lower. Reassessing your cash inflows and outflows is a must.

2. Focus on Operational Efficiency

Making sure your business operations are highly efficient also helps in surviving and thriving after a recession.

While some companies immediately resort to layoffs, others focus first on improving their business model and increasing productivity.

Discontinuing unfruitful projects and focusing manpower to support stronger projects can give an improvement you can continue even after a recession.

Find solutions that decrease the use of your resources, especially capital, without lowering productivity. Consider a digital transformation strategy to help your teams work faster, or switch to cheaper service providers for your tech stack.

3. Outsource

Although you may be adopting the conservation mindset, be careful what expenses you’re cutting in your business! Don’t accidentally cut the meat when you should be cutting the fat from your business. This is often in the form of payroll.

That’s why we always recommend outsourcing, especially during times of economic downturn. It can provide you with access to the global talent tool, help you avoid the consequences of the Great Resignation, and help your business conserve on costs.

Depending on where you outsource to, you can save upward of $60,000 a year per person you hire.

Outsourcing work has been practiced for decades. However, the Great Resignation merely introduced more companies to the concept and its many benefits.

Outsourcing tasks to offshore virtual assistants from cheaper labor markets can help you fill in labor shortages or the high price of labor you experience locally.

You can hire virtual assistants to pick up projects during the recession, or even retain them after you’ve experienced the cost-effectiveness of outsourcing.

4. Keep Marketing

You should continue to market your business even when there’s a recession. With social media marketing, email marketing, and other forms of digital marketing, you should maintain efforts to be on top of your audience’s mind. Luckily, digital forms of marketing take less financial investment and usually yield higher ROI than traditional forms of marketing.

Money’s tight for everyone during a recession, but as long as you showcase your brand’s values and benefits in an appropriate manner, your marketing efforts shouldn’t go to waste.

Your mission here is to align your brand’s values and benefits with what your target market truly needs in a time of economic downturn.

5. Switch to Digital Work

Automation and delegation are two practices that can help increase productivity in your business during a recession.

Leveraging technology and digital work can help you and your team collaborate more, even remotely. This is also practiced by organizations that collaborate digitally and work in remote or hybrid environments.

Try using an automation app like Zapier and see how much faster your team can work. Video conferencing with clients and team members also helps save time and money as opposed to attending personal appointments.

6. Nurture Relationships

Prioritize relationships in your sphere of influence during challenging times. You have relationships with your creditors, vendors, customers, staff, and other stakeholders.

An economic downturn affects everyone, not just your business. Your being there for others can result in them providing the same support to you and your business in so many ways.

Acquiring business through your existing relationships is part of a client retention strategy that shows higher returns than finding new customers.

Similarly, having a cooperative relationship within your sphere of influence can be a fundamental part of your recession survival strategy.

Favorable interest rates and longer payment terms can come out of well-kept business relationships, alleviating some of the financial struggles that come from unpleasant economic situations.

How the Current State of the Economy is Affecting the Real Estate Market

Housing demand in the pandemic era has caused record-low inventories and price inflation in the housing market.

Basically, housing prices have outpaced income growth. That’s a historic 34.4% increase in the past two years that experts now predict to slow down, albeit not anytime soon.

Increasing fed rates, however, threaten investors and homeowners with an increase in mortgage rates. The increasing mortgage rates are also making it harder for people to become first-time homeowners, pushing off the age of young buyers.

This could eventually lead to a recession in the real estate market where inventories are high and buyer confidence is decreased.

Coping Within the Real Estate Market

Market experts continue to identify signs of another housing bubble. High demand, paired with low inventory has already caused significant overpricing of properties in the past 24 months.

The current state of the U.S. economy now warns the real estate market of two things: a bubble and an incoming recession.

Realtors, agents, brokers, and teams may eventually find themselves with more open listings, fewer appointments, and even clients calling about selling ASAP.

According to industry experts, here are a few things you can start doing to help your business avoid the struggle with whatever comes out of the current volatility in the nation’s economy.

7. Optimize Your CRM

Optimize your CRM so you can keep track of the people in your contact list. Segregate them well so you know exactly how to keep in touch with them during an economic crisis.

If you’re an agent, make sure you take a very human approach to keep your contacts engaged. This way, they’ll be more understanding and helpful in keeping your business alive.

8. Work Your Referral Network

It costs more to find new clients than it does to work a referral network. Nurture your relationships with your previous clients so you can have a reliable referral network.

This can be a great source of business during an economic downturn. You can also start talking to more investors while prices are anticipated to soften in the future.

Contrary to first-time buyers, investors in your circles may be interested in benefiting from rising prices and rent during stagflation.

9. Push Pocket Listings

It may finally be time to push your pocket listings more than before. In a challenging economy, even your seller could be more open to offers on their private listing.

Talk to your sellers and people in your network and see how well this can work for you. When a recession comes and you have a lot of pocket listings, pushing them more can become your business’s secret to survival.

When the economy starts to show signs of a recession, talk to your sellers and remind them that it may have unpleasant effects on their investment if your strategy isn’t adjusted immediately. You can do this for all your listings.

10. Consider New Market Opportunities

While an economic downturn directly impacts buyer demand, you may find other markets where demand has increased or is sustained.

Look into changing locations to where the pandemic era has led people to. You can also look into selling properties you wouldn’t normally sell.

One approach to this is teaming up with another realtor or joining a team, which can provide you with the help you may need during an economic crisis.

In a Shifting Market

In an economy as volatile as today’s, it’s important to secure options to keep your finances safe in case of an economic downturn becoming a recession or even stagflation.

Recognizing frequent movements in the pandemic era, realtor Robert Garcia has already made the move of hiring prospecting virtual assistants for his business.

This cost-effective move has helped his business become more productive and successful, as well as prepared for shifts within the real estate market.

Hiring offshore virtual assistants is a strategy that has helped businesses in various industries during economic downturns or financially challenging times.

The current state of the U.S. economy puts businesses, investors, and consumers on high alert about the future. What we can all do right now is prepare for the worst by making adjustments and looking at cost-efficient solutions.

If you'd like the help of a virtual assistant in your business, fill out this form and one of our Consultants will get in touch with you about our services.

More Articles From Virtudesk:

Share this article

Meet our Most Trusted

Partners & Clients

Byron Lazine

Co-Founding Chief-of-Operations at BAM (Broke Agent Media)I’ve been using Virtual Assistants for years throughout all of my companies. Once we found Virtudesk the process got even easier and allowed us to scale out our hiring. Highly skilled and accountable professionals. 100% recommend!

Rebecca Julianna James

Realtor / Content CreatorBefore getting started with Virtudesk I had my doubts that they would find what I was looking for. I needed a very particular person to add to my team and let me tell you I am highly pleased! My virtual assistant Myril is the best! I am excited to grow my socialmedia accounts with her. Thank you Virtudesk!

Chelsea Erickson

Realtor La Belle RE GroupI am very happy with the assistance Virtudesk is providing for my real estate business. This is a newer position for my company and we are working through the creation and efficiency.